SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under Rule 14a-12 |

|

BOSTON BIOMEDICA, INC. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

(1) |

Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

September 2, 2003

Dear Stockholder:

Boston Biomedica, Inc. will hold a Special Meeting in Lieu of Annual Meeting of Stockholders at the offices of Brown Rudnick Berlack Israels LLP, One Financial Center, 19th Floor, Boston, Massachusetts 02111, on Thursday, October 2, 2003 at 10:00 a.m. At the Meeting, stockholders will elect two Class I Directors to hold office until the 2006 Annual Meeting of Stockholders. Detailed information about this vote and the Meeting itself is included in the attached proxy statement.

On behalf of the Board of Directors and employees of Boston Biomedica, Inc., I cordially invite all stockholders to attend the Special Meeting in Lieu of Annual Meeting in person. Whether or not you plan to attend the Meeting, please take the time to vote by completing and returning the enclosed proxy card.

If you plan to attend the Meeting in person, please remember to bring a form of personal identification with you and, if you are acting as a proxy for another stockholder, please bring written confirmation from the record owner that you are acting as a proxy.

Sincerely,

William A. Wilson

Chairman of the Board of Directors

BOSTON BIOMEDICA, INC.

Notice of Special Meeting in Lieu of Annual Meeting of Stockholders of

Boston Biomedica, Inc. to be held on

Thursday, October 2, 2003

The Special Meeting in Lieu of Annual Meeting of Stockholders of BOSTON BIOMEDICA, INC. will be held on Thursday, October 2, 2003 at 10:00 a.m. at the offices of Brown Rudnick Berlack Israels LLP, One Financial Center, 19th Floor, Boston, Massachusetts 02111, for the following purposes:

The Board of Directors has fixed August 20, 2003 as the record date for determining the stockholders entitled to notice of, and to vote at, the Meeting.

You are cordially invited to attend the Meeting.

By

Order of the Board of Directors

Kathleen W. Benjamin

Clerk

West

Bridgewater, Massachusetts

September 2, 2003

You are urged to sign, date and promptly return the accompanying form of proxy, so that, if you are unable to attend the Meeting, your shares may nevertheless be voted. However, your proxy may be revoked at any time prior to exercise by filing with the Clerk or an Assistant Clerk of the Company a written revocation, by executing a proxy with a later date, or by attending and voting at the Meeting.

PROXY STATEMENT

FOR THE SPECIAL MEETING IN LIEU OF ANNUAL MEETING

OF STOCKHOLDERS TO BE HELD

ON OCTOBER 2, 2003

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Boston Biomedica, Inc., a Massachusetts corporation with its principal executive offices at 375 West Street, West Bridgewater, Massachusetts 02379 (the "Company"), for use at the Special Meeting in Lieu of Annual Meeting of Stockholders to be held on Thursday October 2, 2003, at 10:00 a.m. and at any adjournment or adjournments thereof (the "Meeting"). The enclosed proxy relating to the Meeting is solicited on behalf of the Board of Directors of the Company and the cost of such solicitation will be borne by the Company. Certain of the officers and regular employees of the Company may solicit proxies by correspondence, telephone or in person, without extra compensation. The Company may also pay to banks, brokers, nominees and certain other fiduciaries their reasonable expenses incurred in forwarding proxy material to the beneficial owners of securities held by them. It is expected that this proxy statement and the accompanying proxy will be mailed to stockholders on or about September 2, 2003.

Only stockholders of record at the close of business on August 20, 2003 will be entitled to receive notice of, and to vote at, the Meeting. As of July 31, 2003, there were outstanding 6,822,537 shares of Common Stock, $.01 par value, of the Company (the "Common Stock"), all of which are entitled to vote. Each such stockholder is entitled to one vote for each share of Common Stock so held and may vote such shares either in person or by proxy.

The enclosed proxy, if executed and returned, will be voted as directed on the proxy or, in the absence of such direction, for the election of the nominees as Directors. If any other matters shall properly come before the Meeting, the authorized proxy will be voted by the proxies in accordance with their best judgment. The proxy may be revoked at any time prior to exercise by filing with the Clerk or an Assistant Clerk of the Company a written notice of revocation bearing a later date than the proxy, by executing a proxy with a later date, or by attending and voting in person at the Meeting. Record holders should send any written notice of revocation or subsequent dated proxy to the Company's Clerk or Assistant Clerk at 375 West Street, West Bridgewater, MA 02379, or hand deliver the notice of revocation or subsequent dated proxy to the Company's Clerk or Assistant Clerk before the vote at the Meeting.

1

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Meeting, two Class I Directors are to be elected, each to serve until the 2006 Annual Meeting of Stockholders and a successor has been duly elected and qualified.

The Company's Amended and Restated Articles of Organization and Amended and Restated Bylaws, as amended, provide that the Board of Directors shall be divided into three classes. At each Annual Meeting of Stockholders following the initial classification, the Directors elected to succeed those whose terms expire shall be identified as being the same class as the Directors they succeed and shall be elected to hold office for a term to expire at the third Annual Meeting of Stockholders after their election, and until their respective successors are duly elected and qualified, unless an adjustment in the term to which an individual Director shall be elected is made because of a change in the number of Directors.

The Company's Amended and Restated Articles of Organization and Amended and Restated Bylaws, as amended, do not require the stockholders to elect any Directors in a class the term of office of which extends beyond the Meeting. The term of office of only the Class I Directors expires at the Meeting. Mr. Francis E. Capitanio, a current Class I Director and a Director of the Company since 1986, will not stand for re-election as a Class I Director; his term will expire on the date his successor is duly elected and qualified. The terms of office of the Class II and Class III Directors continue after the Meeting.

Dr. Calvin A. Saravis has not been nominated pursuant to any arrangement or understanding with any person. Mr. R. Wayne Fritzsche has been nominated to the Board of Directors pursuant to an Agreement dated as of June 30, 2003 between the Company and Richard T. Schumacher (the "Nominee Agreement"). In April 2003, Mr. Schumacher nominated Mr. Fritzsche and Russell B. Richerson for election as directors at the Company's forthcoming Annual Meeting of Stockholders. At the time of their nomination, Mr. Schumacher's nominees agreed to support the reinstatement of Mr. Schumacher as Chief Executive Officer of the Company. Pursuant to the Nominee Agreement, the Company agreed that Mr. Capitanio would not stand for reelection, and following a further review and consideration of the candidates, the Board of Directors would select one of Mr. Fritzsche or Dr. Richerson as the nominee to fill the vacancy on the Board of Directors created by Mr. Capitanio not standing for reelection. Under the Nominee Agreement, Mr. Schumacher withdrew his two nominees and agreed not to proceed with or undertake any proxy solicitation for the Meeting. The Board of Directors selected Mr. Fritzsche as the nominee. Mr. Schumacher is serving as an Executive Project Consultant to the Company under another agreement which is described under "Certain Relationships and Related Transactions", below.

It is the intention of the persons named as proxies to vote for the election of Mr. R. Wayne Fritzsche and Dr. Calvin A. Saravis as Class I Directors. In the unanticipated event that either of them should be unable to serve, the persons named as proxies will vote the proxy for such substitutes, if any, as the present Board of Directors may designate or to reduce the number of Directors.

2

The following table sets forth certain information with respect to the nominees and each of the Directors whose term extends beyond the Meeting, including the year in which the nominee's term would expire, if elected.

| Name |

Age |

Position |

Director Since |

Year Term Expires, if Elected, and Class |

||||

|---|---|---|---|---|---|---|---|---|

| R. Wayne Fritzsche* | 54 | Nominee for Director | — | 2006 Class I |

||||

| Calvin A. Saravis* (1)(2)(3) | 73 | Director | 1986 | 2006 Class I |

||||

| William A. Wilson (1)(2)(3) | 57 | Chairman of the Board | 2001 | 2004 Class II |

||||

| Kevin W. Quinlan | 53 | President and Chief Operating Officer, Treasurer and Director | 1986 | 2005 Class III |

||||

| Richard T. Schumacher | 52 | Director | 1978 | 2005 Class III |

Mr. R. Wayne Fritzsche has been nominated by the Board of Directors to serve as a Class I Director of the Company. Mr. Fritzsche has served as a member of the Company's Scientific Advisory Board since 1999. Mr. Fritzsche is the founder of Fritzsche & Associates, Inc., a consulting firm which provides strategic, financial, and scientific consulting to medical companies in the life sciences/healthcare arena, and has served as President since 1991. Since 2003, Mr. Fritzsche has also served as interim President of PGBP Pharmaceuticals, a small molecule discovery company, Ultra Imaging, Inc., a handheld imaging device company, and Immune Cell Therapy, Inc., a thrombolytic therapy company. Since 2001, Mr. Fritzsche has served as a board member of Opexa Pharmaceuticals, a multiple sclerosis/cell immunology therapy company, and Vascular Sciences, Inc., an extracorporeal/macular degeneration company. He was also a board member of Intelligent Medical Imaging, an automated microscopic imaging company, from 1994 to 1997, Clarion Pharmaceuticals, a drug development company using novel esters, from 1994 to 1996, Nobex Pharmaceuticals, a drug delivery firm, from 1996 to 2001, Cardio Command, Inc., a transesophageal cardiac monitoring and pacing firm, from 1999 to 2001, and Hesed BioMed, an antisense oligonucleotide and catalytic antibody company from 2000 to 2002. Mr. Fritzsche holds a BA from Rowan University, and an MBA from the University of San Diego.

Dr. Saravis has served as a Director of the Company since 1986. Since 1984, he has been an Associate Professor of Surgery (Biochemistry) at Harvard Medical School (presently emeritus) and an Associate Research Professor of Pathology at Boston University School of Medicine (presently emeritus). From 1971 to 1997, Dr. Saravis was a Senior Research Associate at the Mallory Institute of Pathology and from 1979 to 1997, he was a Senior Research Associate at the Cancer Research Institute-New England Deaconess Hospital. Dr. Saravis received his Ph.D. in immunology and serology from Rutgers University.

Mr. Wilson has served as a Director of the Company since 2001 and was appointed Chairman of the Board effective February 13, 2003. Since May of 2003, Mr. Wilson has been Executive Vice President of Lightship Telecom Holdings, a private telecommunications firm. Since 2001, Mr. Wilson has served as and remains a Member and Director of ET-LLC, a high technology management company where he was Executive Vice President and Chief Operating Officer from 2001 to 2003. From

3

1998 to 2001, Mr. Wilson was the Chief Financial Officer of Interliant, Inc., an internet infrastructure services company; Interliant, Inc. filed for reorganization under Chapter 11 of the Federal Bankruptcy Code on August 5, 2002. Prior to joining Interliant, Mr. Wilson served as Chief Financial Officer at XCOM Technologies, Inc., a competitive local exchange carrier, in 1998. Mr. Wilson received a Bachelor of Arts degree from Luther College, a Master of Science degree from Northeastern University, and a Master of Business Administration degree from Babson College. Mr. Wilson is a Certified Public Accountant.

Mr. Quinlan, a Director of the Company since 1986, has served as President and Chief Operating Officer since August 1999 and Treasurer since June 2001. From January 1993 to August 1999, he served as Senior Vice President, Finance, Chief Financial Officer and Treasurer. From 1990 to December 1992, he was the Chief Financial Officer of ParcTec, Inc., a New York-based leasing company. Mr. Quinlan served as Vice President and Assistant Treasurer of American Finance Group, Inc. from 1981 to 1989 and was employed by Coopers & Lybrand (now PricewaterhouseCoopers LLP) from 1975 to 1981. Mr. Quinlan is a Certified Public Accountant and received a M.S. in accounting from Northeastern University and a B.S. in resource economics from the University of New Hampshire.

Mr. Schumacher, the Founder of the Company, has served as a Director since 1978, and since July 9, 2003, he has served as an Executive Project Consultant to the Company pursuant to a consulting agreement with the Company, as described in the Section entitled "Certain Relationships and Related Transactions" below. He was Chief Executive Officer and Chairman of the Board from 1992 to February 2003, and served as President from 1986 to August 1999. Mr. Schumacher served as the Director of Infectious Disease Services for Clinical Sciences Laboratory, a New England-based medical reference laboratory, from 1986 to 1988. From 1972 to 1985, Mr. Schumacher was employed by the Center for Blood Research, a nonprofit medical research institute associated with Harvard Medical School. Mr. Schumacher received a B.S. in Zoology from the University of New Hampshire.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company held 17 meetings during the fiscal year ended December 31, 2002. In addition, a special committee of independent directors consisting of Messrs. Capitanio, Wilson and Dr. Saravis which was appointed to review the transactions with Mr. Schumacher, as described below under the heading "Certain Relationships and Related Transactions", communicated several times informally and held one formal meeting during fiscal year 2002. Each Director attended at least 75% of the aggregate number of all meetings of the Board of Directors and committees of which he was a member during such fiscal year.

The Board of Directors has an Audit Committee, currently comprised of Messrs. Capitanio, Wilson and Dr. Saravis, which met five times during fiscal year 2002. The functions performed by this Committee primarily include recommending to the Board of Directors the engagement of the independent accountants, reviewing financial statements to be filed with the Securities and Exchange Commission, evaluating the performance and independence of the independent accountants, and reviewing with management any recommendations made by the independent accountants.

The Board of Directors also has a Compensation Committee, currently comprised of Messrs. Capitanio, Wilson and Dr. Saravis. Mr. Capitanio replaced Mr. Schumacher as a member of the Compensation Committee in February 2003. The functions of the Compensation Committee include making recommendations and presentations to the full Board of Directors on compensation levels, including salaries, incentive plans, benefits and overall compensation for officers and Directors, and issuance of stock options to officers, Directors and employees. During fiscal year 2002, the Compensation Committee met three times relative to matters with respect to compensation.

The Board of Directors does not have a nominating committee. The entire Board of Directors considers changes in Directors.

4

Security Ownership of Directors, Officers and Certain Beneficial Owners and Related Stockholder Matters

The following table sets forth certain information as of June 30, 2003 concerning beneficial ownership of Common Stock by each Director, each nominee for Director, each Named Executive Officer in the Summary Compensation Table under "Executive Compensation" below, all Executive Officers and Directors as a group, and each person known by the Company to be the beneficial owner of 5% or more of the Company's Common Stock. Unless otherwise noted, each person identified below possesses sole voting power and investment power with respect to the shares listed. This information is based upon information received from or on behalf of the named individuals.

| Name* |

Number of Shares of Common Stock Beneficially Owned |

Percent of Class |

|||

|---|---|---|---|---|---|

| Richard T. Schumacher (1)(2)* 65 Black Pond Road Taunton, MA 02780 |

707,047 | 10.29 | % | ||

| Kevin W. Quinlan (1) | 102,994 | 1.49 | % | ||

| Mark M. Manak, Ph.D. (1)(3) | 51,864 | ** | |||

| Kathleen W. Benjamin (1) | 19,916 | ** | |||

| Richard J. D'Allessandro (1) | 19,250 | ** | |||

| Calvin A. Saravis, Ph.D. (1) | 29,290 | ** | |||

| R. Wayne Fritzsche (4) | 3,000 | ** | |||

| Francis E. Capitanio (1) | 18,334 | ** | |||

| William A. Wilson (1) | 21,163 | ** | |||

| All Executive Officers and Directors as a group (11 Persons) (1)(2)(3) | 1,047,901 | 15.26 | % | ||

| Richard P. Kiphart (5) * c/o William Blair & Company, L.L.C. 222 West Adams Street Chicago IL 60606 |

1,578,545 | (5)(6) | 23.02 | % | |

| Shoreline Micro-Cap Fund I LP (6)* c/o William Blair & Company, L.L.C. 222 West Adams Street Chicago, IL 60606 |

365,613 | (6) | 5.36 | % |

5

includes 365,613 shares beneficially owned by Shoreline Micro-Cap Fund I LP described in Note 6 below.

Executive Compensation

The following Summary Compensation Table sets forth the compensation during the last three fiscal years of (i) each person who served as Chief Executive Officer during fiscal year 2002, and (ii) the four other most highly compensated Executive Officers of the Company who were serving as Executive Officers at the end of fiscal 2002 and whose total annual salary and bonus, if any, exceeded $100,000 for services in all capacities to the Company during the fiscal year ended December 31, 2002 (collectively, the "Named Executive Officers").

| |

|

Annual Compensation |

Long Term Compensation |

|

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Fiscal Year Ended |

Salary ($) |

Bonus ($) |

Other Annual Compensation |

Securities Underlying Stock Options (#) |

All Other Compensation ($) |

|||||||||

| Richard T. Schumacher, Chief Executive Officer and Chairman of the Board (1)(2) |

12/31/02 12/31/01 12/31/00 |

$ |

245,866 237,500 229,279 |

— — — |

$ |

1,019(5) 1,163(5) 1,550(5) |

90,000 40,000 — |

$ |

6,616(3)(4) 7,703(3)(4) 7,571(3)(4) |

||||||

Kevin W. Quinlan, President and Chief Operating Officer, Treasurer and Director |

12/31/02 12/31/01 12/31/00 |

$ |

191,769 185,000 178,596 |

— — — |

$ |

2,973(5) 3,575(5) 3,575(5) |

107,000 24,000 — |

$ |

2,909(3)(4) 2,854(3)(4) 2,821(3)(4) |

||||||

Mark M. Manak, Ph.D. Senior Vice President and General Manager, BBI Biotech |

12/31/02 12/31/01 12/31/00 |

$ |

147,000 141,346 137,846 |

— — — |

— — — |

46,500 — 5,000 |

$ |

675(4) 638(4) 624(4) |

|||||||

Kathleen W. Benjamin Vice President, Human Resources and Assistant Clerk |

12/31/02 12/31/01 12/31/00 |

$ |

115,508 102,754 95,310 |

— — — |

— — — |

10,000 6,000 — |

$ |

342(4) 212(4) 175(4) |

|||||||

Richard J. D'Allessandro, Vice President, Information Technology |

12/31/02 12/31/01 12/31/00 |

$ |

121,964 117,046 99,580 |

— — — |

— — — |

10,000 6,000 — |

$ |

1,037(4) 853(4) 414(4) |

|||||||

6

institution was used to satisfy the Company's guaranty obligation to the financial institution. For a detailed description of the terms of these transactions, please see "Certain Relationships and Related Transactions" below.

The following tables set forth certain information with respect to the stock options granted to and exercised by the Named Executive Officers during fiscal 2002 and the aggregate number and value of options exercisable and unexercisable held by the Named Executive Officers during fiscal 2002.

Option Grants in Fiscal Year 2002

| |

Individual Grants |

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term at Year End (1) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

% of Total Options Granted to Employees in 2002 |

|

|

|||||||||||

| Name |

Number of Securities Underlying Options Granted (#) |

Exercise Price ($/Sh) |

Expiration Date |

||||||||||||

| 5% ($) |

10% ($) |

||||||||||||||

| Richard T. Schumacher | 60,000 | 11.68 | % | $ | 3.08 | 02/11/12 | $ | 116,220 | $ | 294,524 | |||||

| Richard T. Schumacher | 30,000 | 5.84 | % | 2.70 | 12/02/12 | 47,520 | 123,646 | ||||||||

| Kevin W. Quinlan | 52,000 | 10.12 | % | 3.08 | 02/11/12 | 100,724 | 255,254 | ||||||||

| Kevin W. Quinlan | 55,000 | 10.71 | % | 2.70 | 12/02/12 | 87,120 | 226,685 | ||||||||

| Mark M. Manak, Ph.D. | 11,500 | 2.24 | % | 3.08 | 02/11/12 | 22,275 | 56,450 | ||||||||

| Mark M. Manak, Ph.D. | 35,000 | 6.81 | % | 2.70 | 12/02/12 | 55,440 | 144,254 | ||||||||

| Kathleen W. Benjamin | 5,000 | 0.97 | % | 3.08 | 02/11/12 | 9,685 | 24,544 | ||||||||

| Kathleen W. Benjamin | 5,000 | 0.97 | % | 2.70 | 12/02/12 | 7,920 | 20,608 | ||||||||

| Richard J. D'Allessandro | 5,000 | 0.97 | % | 3.08 | 02/11/12 | 9,685 | 24,544 | ||||||||

| Richard J. D'Allessandro | 5,000 | 0.97 | % | 2.70 | 12/02/12 | 7,920 | 20,608 | ||||||||

7

year period from the date of the grant, and must generally be exercised with 30 days after the end of the optionee's status as an employee.

Aggregated Option Exercises in Last

Fiscal Year and Fiscal Year End Option Values

| |

|

|

Number of Securities Underlying Unexercised Options at Year End (#)(2) |

Value of Unexercised In-the-Money Options at Year End ($)(3) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($)(1) |

|||||||||||||

| Exercisable |

Un-exercisable |

Exercisable |

Un-exercisable |

||||||||||||

| Richard T. Schumacher | 2,380 | $ | 434 | 55,000 | 120,000 | $ | 4,000 | $ | 21,000 | ||||||

| Kevin W. Quinlan | — | — | 47,875 | 115,625 | 6,525 | 19,575 | |||||||||

| Mark M. Manak, Ph.D. | — | — | 19,750 | 40,250 | 2,625 | 7,875 | |||||||||

| Kathleen W. Benjamin | — | — | 15,000 | 15,000 | 750 | 3,750 | |||||||||

| Richard J. D'Allessandro | — | — | 15,500 | 14,500 | 750 | 3,750 | |||||||||

Compensation of Directors

Non-employee Directors of the Company received a quarterly stipend of $2,500, for a yearly total of $10,000 for their services in 2002. In addition, in 2002, each non-employee Director who is a member of the Audit Committee received an additional $500 per quarter for a yearly total of $2,000 and each non-employee Director who is a member of the Compensation Committee received an additional $500 per quarter for a yearly total of $2,000. Each Director is eligible to receive options to purchase Common Stock under the Company's 1999 Non-Qualified Stock Option Plan. Non-employee Directors of the Company are granted a minimum of 15,000 non-qualified stock options at the start of their term of service, which generally vest over a three year period and have an exercise price equal to the fair market value of the underlying shares on the date of the grant. In February 2003, Mr. Wilson and Dr. Saravis were appointed to a Special Oversight Committee (the "Oversight Committee") for the purpose of overseeing the management of the affairs of the Company until such time as a new Chief Executive Officer is employed. In recognition of the significant additional effort and time Mr. Wilson and Dr. Saravis are required to devote to their responsibilities on the Oversight Committee, Mr. Wilson and Dr. Saravis are paid $1,200 per day worked, averaging two days per month for Dr. Saravis. Please also see "Certain Relationships and Related Transactions" below.

Compensation Committee Interlocks and Insider Participation

For the fiscal year ended December 31, 2002, the Board of Directors made decisions regarding executive compensation based on the recommendations of those members of the Board of Directors who also serve on the Compensation Committee. For the fiscal year ended December 31, 2002, the individuals who served on the Compensation Committee and who make recommendations to the full Board of Directors consisted of Richard T. Schumacher, Dr. Calvin A. Saravis, and William A. Wilson, each of whom has received options to purchase Common Stock. Mr. Schumacher served as the Chief

8

Executive Officer and Chairman of the Board of the Company in fiscal year 2002. Effective February 2003, Mr. Capitanio replaced Mr. Schumacher as a member of the Compensation Committee. Please see "Certain Relationships and Related Transactions" below, for a description of certain related party transactions between the Company and Mr. Schumacher. Neither Dr. Saravis, Mr. Capitanio nor Mr. Wilson is a current or former officer or employee of the Company.

In fiscal 2002, the members of the Compensation Committee met three times and made recommendations regarding executive compensation at meetings of the full Board of Directors. The full Board of Directors then made final decisions regarding executive compensation. Neither Mr. Schumacher nor Mr. Quinlan participated in any vote or deliberations establishing their own compensation.

Board of Directors Report on Executive Compensation

As described above under the heading "Compensation Committee Interlocks and Insider Participation", for the fiscal year ended December 31, 2002, the full Board of Directors made decisions regarding executive compensation based on the recommendations of those members of the Board of Directors who serve on the Compensation Committee. These recommendations were made at meetings of the full Board of Directors. The Compensation Committee met three times during fiscal year 2002. The Compensation Committee made recommendations and presentations to the full Board of Directors on compensation levels, including salaries, incentive plans, benefits and overall compensation for officers and Directors and issuance of stock options to officers, Directors and employees. Subsequent to the recommendations of the Compensation Committee, the Board of Directors voted on the Committee's proposals.

The primary objective in determining the type and amount of Executive Officer compensation is to provide a level of base compensation which allows the Company to attract and retain superior talent. The Board of Directors endeavors to align the Executive Officer's interests with the success of the Company through participation in the Company's employee stock option plan, which provides the Executive Officer with the opportunity to build a substantial ownership interest in the Company.

The compensation of Executive Officers includes cash compensation, the grant of stock options, and participation in benefit plans generally available to employees. In determining base salary, consideration is given to executive compensation for comparably sized companies as well as the individual experience and performance of each Executive Officer and the performance of the Company generally. Base salary recommendations are at a level believed to be comparable to cash compensation of officers with similar responsibilities in similarly situated corporations.

Each of the Executive Officers (including Mr. Schumacher through February 2003), and all full-time employees are eligible to receive grants of options under the Company's employee stock option plans. The employee stock option plans are used to provide incentives to officers and employees and to associate more closely the interests of such persons with stockholders' interests and the long-term success of the Company. In determining the number of options to be granted to each Executive Officer or employee, a subjective determination is based on factors such as the individual's level of responsibility, performance, and number of options held. During fiscal 2002, a total of 263,500 options were granted to the Named Executive Officers under the employee stock option plans.

In 2002, the Company's Board of Directors established a target bonus program for Mr. Schumacher and Mr. Quinlan. There were no bonuses accrued nor paid in year 2002 pursuant to this program. During the fiscal year ended December 31, 2002, Mr. Schumacher, the Company's Chief Executive Officer, received a base salary of $245,866. The Board of Directors believes that this compensation is comparable to the cash compensation of Chief Executive Officers of comparable companies. During the fiscal year ended December 31, 2002, Mr. Schumacher was granted 90,000 non-qualified stock options pursuant to the Company's 1999 Nonqualified Stock Option Plan.

9

From October 2000 to July 2001, the Company made payments totaling $18,729 on a personal loan from a bank to Mr. Schumacher. These amounts have not been repaid to date. The Company and Mr. Schumacher are continuing to dispute the obligation to repay these amounts.

In 2001, the Company's Board of Directors authorized loans from the Company to Mr. Schumacher totaling $450,000. Mr. Schumacher borrowed an additional $75,000 from the Company late in 2001. In January 2002, the principal of these loans was repaid in full with a portion of the proceeds described in the following sentence. The Company's loans were replaced by the Company's pledge of a $1,000,000 interest bearing deposit at a financial institution to secure the Company's limited guaranty of loans in the aggregate amount of $2,418,000 from the financial institution to an entity controlled by Mr. Schumacher. The Company's pledge is secured by a junior subordinated interest in the collateral provided by Mr. Schumacher to the financial institution. Such collateral includes certain of his real property and all of his Company common stock in Boston Biomedica, Inc.

The Company's original loan and subsequent pledge of $1,000,000 were made to assist Mr. Schumacher in refinancing indebtedness related to, among other things, his divorce settlement and to enable him to avoid the need to sell his Company common stock on the open market to satisfy his debts. The Company's Board of Directors and, with respect to the decision to pledge the $1,000,000 cash collateral, a special committee of the independent directors, evaluated a number of options and concluded that the original loan to Mr. Schumacher and the subsequent pledge were the best option and in the best interests of the Company's stockholders in the belief that it would, among other things, avoid selling pressure on the Company's common stock and relieve the financial pressures on Mr. Schumacher that could otherwise divert his attention from the Company.

Mr. Schumacher did not repay the loan to the financial institution by the maturity date of December 31, 2002. In January 2003, the $1,000,000 account was used to satisfy the Company's limited guaranty obligation to the financial institution. The Company has now satisfied its obligation under the limited guaranty and pledge with the financial institution through the financial institution's calling of the Company's pledged cash. The Company continues to maintain its junior interest in collateral pledged by Mr. Schumacher to the financial institution. For a more detailed discussion of this transaction, please see "Certain Relationships and Related Transactions" below.

The Compensation Committee, in determining the Chief Executive Officer's and the President's compensation, reviews compensation for chief executive officers and presidents of publicly-held companies of similar size, including those in business of detection and treatment of infectious diseases and similar businesses, their individual performance against quantitative and qualitative goals, and our Company's performance.

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction for compensation over $1,000,000 paid by a public company to its chief executive officer and its four other most highly compensated executive officers. Qualifying "performance-based" compensation is not subject to the deduction limit if specified requirements are met. The Board of Directors generally intends to structure stock options granted to its executive officers in a manner to qualify as performance-based compensation under Section 162(m). While the Board of Directors does not currently intend to qualify cash compensation as performance-based compensation for purposes of Section 162(m), it will continue to monitor the impact of Section 162(m) on the Company.

Board of Directors:

| William A. Wilson | Kevin W. Quinlan | |||

| Francis E. Capitanio | Calvin A. Saravis | Richard T. Schumacher |

10

Audit Committee Report

The Board of Directors has an Audit Committee, which is currently comprised of three non-employee members, Messrs. Capitanio, Wilson and Dr. Saravis. These three members of the Company's Audit Committee are "independent" as that term is defined under the listing standards of the Nasdaq National Market.

The Audit Committee operates pursuant to a written charter (the "Audit Committee Charter") which was adopted by the Board of Directors on June 14, 2000 and subsequently amended on April 23, 2001. Under the provisions of the Audit Committee Charter (a copy of which was included in Company's proxy statement for its Annual Meeting of Stockholders held on June 21, 2001), the Audit Committee is responsible for, among other things, recommending to the Board of Directors the engagement of the independent accountants, reviewing the scope of internal controls and reviewing the implementation by management of recommendations made by the independent accountants. The Company intends to amend its Audit Committee Charter, if necessary, to comply with any final rules and regulations promulgated by the SEC and the Nasdaq Stock Market in response to the mandates of the Sarbanes-Oxley Act of 2002. The Audit Committee held five meetings during fiscal 2002.

The Audit Committee has reviewed and discussed the Company's audited financial statements for the year ended December 31, 2002 with management of the Company. The Audit Committee also discussed with PricewaterhouseCoopers LLP, the Company's independent accountants, the matters required to be discussed by the Auditing Standards Board Statement on Auditing Standards No. 61, as amended. As required by Independence Standards Board Standard No. 1, as amended, "Independence Discussion with Audit Committees," the Audit Committee has received and reviewed the required written disclosures and a confirming letter from PricewaterhouseCoopers LLP regarding their independence, and has discussed the matter with the independent accountants. Based upon its review and discussions of the foregoing, the Audit Committee recommended to the Company's Board of Directors that the Company's audited financial statements for the year ended December 31, 2002 be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002, filed with the Securities and Exchange Commission on March 31, 2003.

| Audit Committee: | ||||

William A. Wilson |

Francis E. Capitanio |

|||

| Calvin A. Saravis |

11

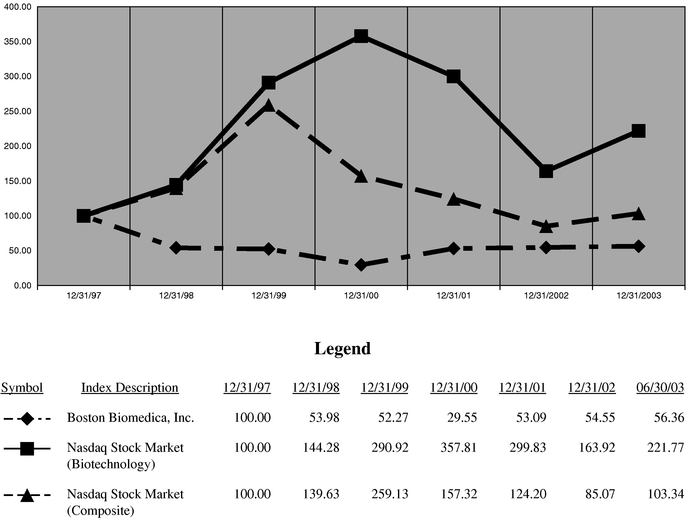

The following graph compares the change in the Company's cumulative total stockholder return from December 31, 1997 to June 30, 2003, which includes the last trading day of fiscal 2002, with the cumulative total return on the Nasdaq Stock Market Index (Composite) and the Nasdaq Stock Market Index (Biotechnology) (SIC 2830-2839 U.S. and Foreign) for that period.

Assumes $100 invested on December 31, 1997 in the Company's Common Stock, the Nasdaq Stock Market Index (Biotechnology) and the Nasdaq Stock Market Index (Composite), and the reinvestment of any and all dividends.

12

Certain Relationships and Related Transactions

Richard P. Kiphart

In August 2000, the Company issued $3,250,000 of 3% Senior Subordinated Convertible Debentures ("the Debentures") to investors, of which $780,000 were issued to Mr. Richard P. Kiphart and $220,000 were issued to Shoreline Micro-Cap Fund I L.P. In January 2001, Mr. Kiphart and Shoreline Micro-Cap Fund I L.P. exercised their conversion rights associated with these Debentures, thereby receiving 662,685 shares of Common Stock of the Company. In December 2001, the Company sold an additional 600,000 shares of Common Stock of the Company for an aggregate purchase price of $1,500,000 in a private placement to five accredited investors including 430,000 shares which were purchased by Mr. Kiphart. The shares were issued in the first quarter of fiscal 2002.

On October 25, 2002, the Company retained the investment banking firm of William Blair & Company to advise the Company in the evaluation of strategic opportunities aimed at increasing shareholder value and liquidity by increasing the capital needed for growth. Mr. Richard P. Kiphart, an investor who owns or controls approximately 23.02% of the common stock of the Company, is a Principal and Head of the Corporate Finance Department of William Blair & Company. This engagement is ongoing as of the date of this proxy statement.

Richard T. Schumacher

From October 2000 to July 2001, the Company made payments totaling $18,729 on a personal loan from a bank to Mr. Schumacher. These amounts have not been repaid to date. The Company and Mr. Schumacher are continuing to dispute the obligation to repay these amounts.

In 2001, the Company's Board of Directors authorized loans from the Company to Richard T. Schumacher, the Company's former Chairman and Chief Executive Officer and a current Director of the Company, totaling $450,000. Mr. Schumacher borrowed an additional $75,000 from the Company late in 2001. The one year loan was renewable at the Company's option, and collateralized by 90,000 of Mr. Schumacher's shares of the Company's common stock. This loan constituted an increase from the $350,000 that had been loaned to Mr. Schumacher as of September 30, 2001. Interest on the loan was payable monthly at the annual rate of 7%, of which $8,216 was remitted to the Company in 2003.

In January 2002, the principal of the loan was repaid in full with a portion of the proceeds of the loans described in the following sentence. The Company's loan was replaced by the Company's limited guaranty and pledge of a $1,000,000 interest bearing deposit at a financial institution to secure the Company's limited guaranty of loans in the aggregate amount of $2,418,000 from the financial institution to an entity controlled by Mr. Schumacher. The loans are personally guaranteed by Mr. Schumacher. The Company's pledge is secured by a junior subordinated interest in the collateral provided by Mr. Schumacher to the financial institution. Such collateral includes certain of his real property and all of his Company common stock.

The Company's original loan and subsequent pledge of $1,000,000 were made to assist Mr. Schumacher in refinancing indebtedness related to, among other things, his divorce settlement and to enable him to avoid the need to sell his Company common stock on the open market to satisfy his debts. The Company's Board of Directors and, with respect to the decision to pledge the $1,000,000 cash collateral, a special committee of the independent directors, evaluated a number of options and concluded that the original loan to Mr. Schumacher and the subsequent pledge were the best option and in the best interests of the Company's stockholders in the belief that it would, among other things, avoid selling pressure on the Company's common stock and relieve the financial pressures on Mr. Schumacher that could otherwise divert his attention from the Company.

Mr. Schumacher did not repay the loan to the financial institution by the maturity date of December 31, 2002. In January 2003, the $1,000,000 account was used to satisfy the Company's limited

13

guaranty obligation to the financial institution. The Company has now satisfied its obligation under the limited guaranty and pledge with the financial institution through the financial institution's calling of the Company's pledged cash. The Company continues to maintain its junior interest in collateral pledged by Mr. Schumacher to the financial institution.

On July 9, 2003, the Company announced Mr. Schumacher agreed to accept an engagement with the Company as a full time Executive Project Consultant to advise the Company with respect to the strategic direction of the Company's PCT and BBI Source Scientific activities and the Company's ownership interest in Panacos Pharmaceuticals, Inc. BBI Source Scientific is the Company's California-based instrument subsidiary, which developed and manufactures the PCT Barocycler instrument. As part of this engagement, Mr. Schumacher is expected to reevaluate the ongoing business prospects for both the Laboratory Instrumentation segment and PCT activities prior to the end of year 2003. Pursuant to the agreement between the Company and Mr. Schumacher (the "Consultant Agreement"), the Company will pay Mr. Schumacher $4,808 per week, which is the equivalent of an annualized salary of $250,000, prorated for the number of weeks between July 1, 2003 and December 31, 2003, the term of the Consultant Agreement. Mr. Schumacher will also be entitled to health and medical insurance, disability insurance, group life insurance, group travel insurance, and 401(k) retirement plan applicable to all full time employees of the Company.

AMENDMENT OF BYLAWS

At a Board of Directors meeting held on February 13, 2003, an amendment to Section 3.8 of the Company's Amended and Restated By-Laws, as amended, was approved. This amendment grants the Company's Board of Directors the authority to appoint a Chairman of the Board and/or a Chief Executive Officer. Prior to this amendment, the President of the Company would preside over any meeting of the Company's Board of Directors in the absence of the Chief Executive Officer.

As amended, Section 3.8 of the Company's Amended and Restated Bylaws, as amended, now provides:

"Section 3.8. CHAIRMAN, CEO AND PRESIDENT. The board of directors may appoint a chairman of the board. If the board of directors appoints a chairman of the board, he shall preside at all meetings of the board of directors and perform such other duties and possess such other powers as are assigned to him by the board of directors. The board of directors may appoint a chief executive officer. If the board of directors appoints a chief executive officer, he shall, subject to the direction of the board of directors, have general charge and supervision of the business of the corporation and, unless otherwise provided by the board of directors, shall preside at all meetings of the stockholders. The president shall perform such duties and shall possess such powers as the board of directors or chief executive officer, if any, may from time to time prescribe."

This proxy statement shall serve as notice to stockholders of the amendment to the Company's Amended and Restated Bylaws, as amended, pursuant to Section 17 of Chapter 156B of the General Laws of Massachusetts.

OTHER MATTERS

Voting Procedures

An inspector of elections appointed by the Company will tabulate the votes of stockholders present in person or represented by proxy at the Meeting. A quorum, consisting of a majority of all of the shares of Common Stock issued, outstanding and entitled to vote at the Meeting, will be required to be present in person or by proxy for consideration of the proposal to elect two Class I Directors. The two nominees for Director of the Company who receive the greatest number of votes cast by stockholders

14

present in person or represented by proxy at the Meeting and entitled to vote thereon will be elected as Directors of the Company.

The inspector of elections will count shares represented in person or by proxy that withhold authority to vote for a nominee for election as a director or that reflect abstentions and "broker non—votes" (i.e., shares represented at the Meeting held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote, and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) as shares that are present and entitled to vote on the matters for purposes of determining the presence of a quorum; but neither proxies that withhold authority to vote for any nominee (without naming an alternative nominee), abstentions nor broker non-votes will be counted as votes cast at the Meeting. As a result, such proxies will not be a factor for the election of directors at the Meeting.

If your shares of the Company's Common Stock are held by your broker and you wish to vote those shares in person at the Meeting, you must obtain from the nominee holding your shares and deliver to the inspector of elections at the Meeting a properly executed legal proxy, identifying you as a stockholder of the Company, authorizing you to act on behalf of the nominee at the Meeting and specifying the number of shares with respect to which the authorization is granted.

Disclosure of Relationships with Independent Accountants

PricewaterhouseCoopers LLP served as the Company's independent accountants for the fiscal year ended December 31, 2002.

On August 22, 2003, PricewaterhouseCoopers LLP resigned as the independent accountants of the Company, effective August 22, 2003. The reports of PricewaterhouseCoopers LLP on the Company's consolidated financial statements for each of the fiscal years ended December 31, 2001 and December 31, 2002 did not contain an adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended December 31, 2001 and December 31, 2002 and through August 22, 2003, there were no disagreements with PricewaterhouseCoopers LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PricewaterhouseCoopers LLP, would have caused PricewaterhouseCoopers LLP to make reference to the subject matter of the disagreement in connection with their report on the financial statements for such years. In addition, during the fiscal years ended December 31, 2001 and December 31, 2002 and through August 22, 2003, there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

Notwithstanding its resignation, it is expected that a representative of PricewaterhouseCoopers LLP will be present at the time of the Meeting and will be available to respond to appropriate questions.

The Audit Committee of the Board of Directors is presently considering the engagement of a new firm to serve as the Company's independent accountants for the fiscal year ending December 31, 2003 and expects to make such recommendation to the Board of Directors as soon as practicable.

Audit Fees

PricewaterhouseCoopers LLP billed aggregate fees to the Company totaling $170,000 in connection with the audit of the Company's annual financial statements for the year ended December 31, 2002 and for the reviews of the financial statements included in each of the Company's quarterly reports on Form 10-Q filed during year 2002.

15

Financial Information Systems Design and Implementation Fees

The Company did not engage the services of PricewaterhouseCoopers LLP in year 2002 for any financial information systems design and implementation services.

All Other Fees

PricewaterhouseCoopers LLP billed aggregate fees totaling $49,000 for other professional services provided in year 2002 relating to the review of income tax returns and other miscellaneous tax services.

The Audit Committee of the Board of Directors believes the performance of the services described under the captions "Financial Information Systems Design and Implementation Fees" and "All Other Fees" during year 2002 by PricewaterhouseCoopers LLP is compatible with maintaining and did not affect such auditor's independence.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's Executive Officers and Directors, and persons who own more than 10% of the Company's Common Stock, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission and Nasdaq. Executive Officers, Directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely on the Company's review of the copies of such filings it has received and written representations from certain reporting persons, the Company believes that all of its Executive Officers, Directors and greater than 10% stockholders complied with all Section 16(a) filing requirements applicable to them during the Company's fiscal year ended December 31, 2002.

Other Proposed Action

The Board of Directors knows of no matters which may come before the Meeting other than the matters described in this proxy statement. However, if any other matters should properly be presented to the Meeting, the persons named as proxies shall have discretionary authority to vote the shares represented by the accompanying proxy in accordance with their own judgment.

Stockholder Proposals

Proposals which stockholders intend to present at the Company's 2004 Annual Meeting of Stockholders and wish to have included in the Company's proxy materials pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, must be received by the Company no later than May 5, 2004.

Stockholders who wish to make a proposal at the Company's 2004 Annual Meeting—other than one that will be included in the Company's proxy materials—should notify the Company no later than July 19, 2004. If a proponent who wishes to present such a proposal at the 2004 Annual Meeting fails to notify the Company by this date, the proxies solicited by the Board of Directors, with respect to such Meeting, may grant discretionary authority to the proxies named therein, to vote with respect to such matter if such matter is properly brought before the Meeting. If a stockholder makes a timely notification, the proxies may still exercise discretionary authority under circumstances consistent with the proxy rules of the Securities and Exchange Commission.

16

Incorporation By Reference

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, the sections of the Proxy Statement entitled "Board of Directors Report on Executive Compensation", "Audit Committee Report", and "Performance Graph" shall not be deemed to be so incorporated, unless specifically otherwise provided in any such filing.

Annual Report on Form 10-K

Additional copies of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002 as filed with the Securities and Exchange Commission are available to stockholders without charge upon written request addressed to Investor Relations, Boston Biomedica, Inc., 375 West Street, West Bridgewater, Massachusetts 02379.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, STOCKHOLDERS ARE URGED TO FILL IN, SIGN AND RETURN THE ACCOMPANYING FORM OF PROXY IN THE ENCLOSED ENVELOPE.

17

| PROXY | BOSTON BIOMEDICA, INC. | PROXY |

The undersigned hereby appoint Kevin W. Quinlan and Kathleen W. Benjamin, acting singly, with full power of substitution, attorneys and proxies to represent the undersigned at the 2003 Special Meeting in Lieu of Annual Meeting of Stockholders of Boston Biomedica, Inc. to be held on Thursday, October 2, 2003 and at any adjournment or adjournments thereof, with all power which the undersigned would possess if personally present, and to vote all shares of stock which the undersigned may be entitled to vote at said meeting upon the matters set forth in the Notice of and Proxy Statement for the Meeting in accordance with the following instructions and with discretionary authority upon such other matters as may come before the Meeting. All previous proxies are hereby revoked.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. IT WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED AND IF NO DIRECTION IS INDICATED, IT WILL BE VOTED FOR THE ELECTION OF THE NOMINEES AS DIRECTORS.

Continued,

and to be signed, on reverse side

(Please fill in the reverse side and mail in enclosed envelope)

ý Please mark votes as in this example.

The Board of Directors recommends a vote FOR the election of the nominees as Directors.

Nominees: R. Wayne Fritzsche and Calvin A. Saravis

o FOR ALL NOMINEES (except as marked to the contrary below)

o WITHHOLD AUTHORITY to vote for all nominees

For all nominees except as noted in the space provided above

| o | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT |

(Signatures should be the same as the name printed hereon. Executors, administrators, trustees, guardians, attorneys, and officers of corporations should add their titles when signing).

Signature: _______________________________ Title:______________________ Date:__________

Signature: _______________________________ Title:______________________ Date:__________

2